Articles

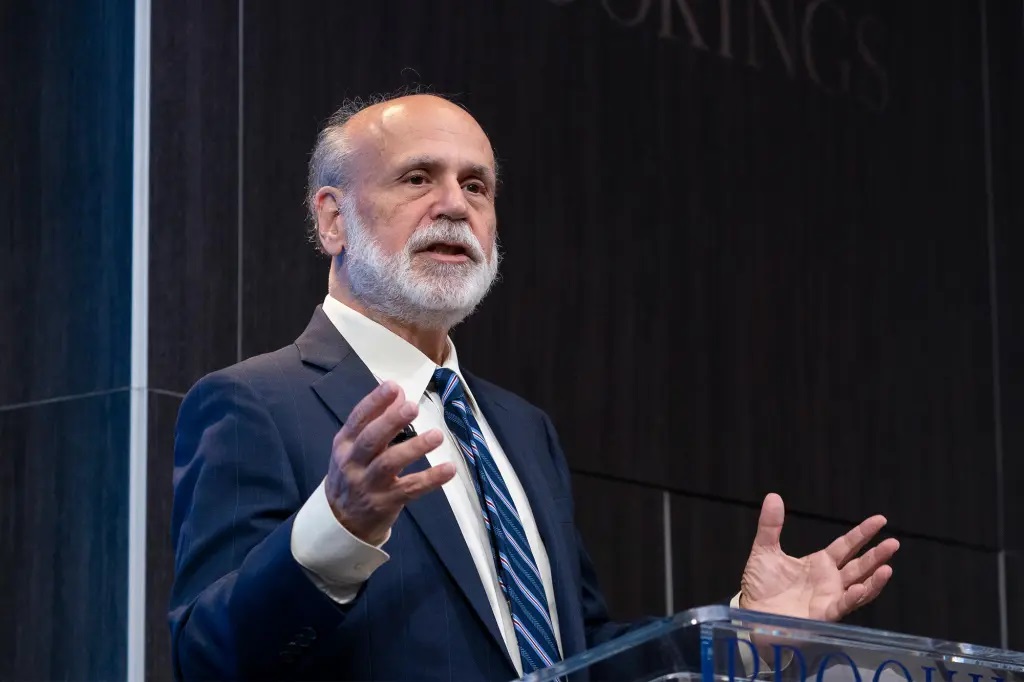

Bernanke Hints Next Rate Increase Will Be the Last

The Fed's preferred inflation gauge, the personal consumption expenditures price index, climbed 3.8% year on year in May.

Bernanke Hints Next Rate Increase Will Be the Last

Former Federal Reserve Chairman Ben Bernanke believes the Federal Reserve's widely anticipated interest rate hike next week will be the last in its current credit-tightening effort.

"It looks very clear that the Fed will raise another 25 basis points at its next meeting," he stated Thursday during a Fidelity Investments webinar. "It's possible that the July increase will be the last."

Investors appear to be in agreement. According to trading in the federal funds futures market, they are pricing in a near certainty of a rate hike at the Fed's July 25-26 meeting, with modest possibilities of a subsequent increase.

Bernanke, speaking as a senior consultant to Pacific Investment Management Co., predicted that inflation will decrease "more durably" to the 3% to 3.5% level over the following six months as rent rises subside and automotive prices fall.

"We'll get to three, three plus by early next year, and then I think the Fed will take its time trying to get down to its 2% target," Bernanke said.

The Fed's preferred inflation gauge, the personal consumption expenditures price index, climbed 3.8% year on year in May. The core PCE price index, which includes food and energy expenses and is considered more reflective of underlying trends by Fed officials, rose 4.6%.

Bernanke said the Fed will wait for a greater labor-market balance before declaring triumph in its fight against inflation. "It's still pretty hot," he said of the labour market.

While job openings have decreased, there are still approximately 1.6 vacant employment for every unemployed person.

The former Fed chair predicted a downturn in the United States as a cost of lowering inflation, albeit he underlined that any recession would be brief.

"What we'll see is a very modest increase in unemployment and a slowing of the economy," he said. "However, I'd be surprised to see a deep recession in the next year."